1. Introduction <a name=”introduction”></a>

Accounting is an integral part of any business, no matter its size. It involves recording financial transactions, managing accounts, and producing financial statements. The advent of accounting software has revolutionized the way businesses handle their finances, making it more efficient, accurate, and accessible. In 2023, the landscape of accounting software services is diverse and competitive, with options catering to different business needs, industries, and sizes.

Whether you’re a startup entrepreneur, a small business owner, or part of a larger organization, choosing the right accounting software can significantly impact your financial operations. To make an informed decision, it’s essential to understand why accounting software matters and what factors you should consider when selecting one.

2. Why Accounting Software Matters <a name=”why-accounting-software-matters”></a>

Before diving into the specifics of accounting software services in 2023, let’s discuss why accounting software is crucial for businesses:

Efficiency and Accuracy

Accounting software automates many time-consuming and error-prone tasks, such as data entry and calculations. This not only saves time but also reduces the risk of human error, ensuring that financial records are accurate and reliable.

Real-Time Financial Insights

With accounting software, you can access up-to-date financial information at your fingertips. This real-time data empowers you to make informed decisions and adapt to changing market conditions quickly.

Tax Compliance

Accounting software often comes with built-in features to help you stay compliant with tax regulations. This can be a significant relief during tax season and helps prevent costly penalties or audits.

Cost Savings

While accounting software typically comes with a cost, the long-term savings in time and resources often outweigh the initial investment. The software streamlines processes and reduces the need for manual bookkeeping.

Scalability

As your business grows, your accounting needs will evolve. Many accounting software solutions are scalable, allowing you to expand your usage as your business expands.

Reporting and Analysis

Modern accounting software offers robust reporting and analysis tools. These enable you to gain deeper insights into your financial performance and make data-driven decisions for the future.

Security

Data security is paramount in accounting. Leading accounting software services employ advanced security measures to protect sensitive financial information.

Accessibility

Cloud-based accounting software allows you to access your financial data from anywhere with an internet connection. This flexibility is particularly valuable for businesses with remote or distributed teams.

Integration with Other Tools

Many accounting software solutions integrate with other business tools, such as CRM software or e-commerce platforms, enhancing overall productivity and workflow.

Now that we understand the importance of accounting software, let’s delve into what you should consider when choosing the best software for your business.

3. What to Consider When Choosing Accounting Software <a name=”what-to-consider”></a>

Choosing the right accounting software is not a one-size-fits-all decision. Your choice should align with your business’s specific needs, industry, and goals. To make an informed decision, here are some crucial factors to consider:

Scalability

Consider the future of your business. Will the software accommodate your needs as you grow? It’s essential to select software that can scale with your business without requiring a significant overhaul.

Ease of Use

User-friendliness is crucial. A complex accounting system can be overwhelming, especially for small business owners with limited accounting experience. Look for software that is intuitive and offers training resources.

Cost

Different accounting software services have varied pricing models. Some charge a monthly subscription fee, while others bill based on the number of users or transactions. Determine your budget and find software that aligns with it.

Integration

If your business relies on other software tools, such as a CRM or e-commerce platform, ensure that your chosen accounting software can integrate with these tools. Seamless integration improves overall efficiency.

Automation and Reporting

Automation can save you time and reduce errors. Look for software that automates tasks like bank reconciliations and provides robust reporting and analysis features.

Customer Support

Inevitably, you may encounter questions or issues with your accounting software. Assess the quality of customer support offered by the software provider, including available support channels and response times.

Security

Data security is paramount when handling financial information. Ensure that the software provider employs advanced security measures to protect your data.

Industry-Specific Features

Depending on your industry, you may need specific features. For example, if you run a law firm, you might require trust accounting functionality. Choose software that caters to your industry’s unique needs.

Now that you have a better understanding of what to look for in accounting software, let’s dive into the best accounting software services available in 2023.

4. The Best Accounting Software Services of 2023 <a name=”best-accounting-software”></a>

In this section, we will explore some of the best accounting software services of 2023. We’ll discuss their key features, benefits, and pricing structures. Whether you’re a freelancer, a small business owner, or part of a large corporation, there’s a solution that suits your needs.

4.1. QuickBooks Online <a name=”quickbooks-online”></a>

QuickBooks Online is a widely recognized name in the accounting software industry. It’s designed for small and medium-sized businesses, offering a comprehensive suite of features for managing finances and accounting tasks. QuickBooks Online is known for its user-friendly interface, making it accessible to those without a deep accounting background.

Key Features:

- Invoicing and payment processing

- Expense tracking

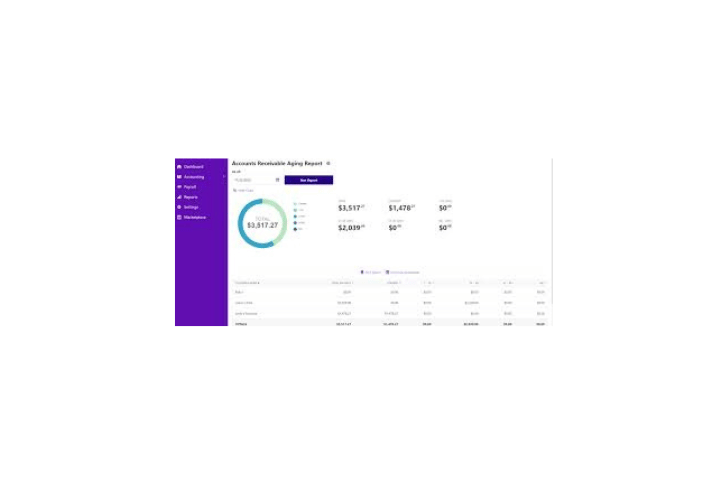

- Financial reporting

- Inventory management

- Integration with various third-party apps

Benefits:

- User-friendly interface

- Scalable for small to medium-sized businesses

- Robust reporting and analytics

- Extensive integrations with other software

- Mobile app for on-the-go management

Pricing: QuickBooks Online offers multiple pricing plans, starting at $25 per month and ranging up to $150 per month for more advanced features. They often run promotions and discounts for new users.

4.2. Xero <a name=”xero”></a>

Xero is another popular accounting software option that caters to small and medium-sized businesses. It’s known for its cloud-based approach, enabling users to access their financial data from anywhere with an internet connection. Xero places a strong emphasis on collaboration, allowing multiple users to work on the same data simultaneously.

Key Features:

- Online invoicing

- Expense claims

- Bank reconciliation

- Financial reporting

- Payroll (available as an add-on)

Benefits:

- Cloud-based, enabling access from anywhere

- User collaboration

- Real-time financial data

- Integration with hundreds of third-party apps

- Strong mobile app

Pricing: Xero offers three pricing plans, starting at $12 per month for basic features and going up to $40 per month for more comprehensive accounting tools.

4.3. FreshBooks <a name=”freshbooks”></a>

FreshBooks is a cloud-based accounting solution primarily designed for freelancers and small business owners. It’s known for its simplicity and user-friendliness. FreshBooks offers features for invoicing, expense tracking, time tracking, and reporting, making it an ideal choice for service-based businesses.

Key Features:

- Invoicing and payment processing

- Expense tracking

- Time tracking

- Financial reporting

- Client portal for collaboration

Benefits:

- Easy-to-use interface

- Designed for freelancers and service-based businesses

- Time tracking for billable hours

- Strong invoicing and payment features

- Client portal for communication

Pricing: FreshBooks offers three pricing plans, starting at $15 per month and going up to $50 per month for additional features.

4.4. Zoho Books <a name=”zoho-books”></a>

Zoho Books is part of the Zoho Suite, a collection of cloud-based applications for businesses. It caters to a wide range of businesses, from freelancers to larger enterprises. Zoho Books offers a user-friendly interface and a variety of features to manage your accounting needs.

Key Features:

- Invoicing and payment processing

- Expense tracking

- Inventory management

- Project accounting

- Banking and reconciliation

Benefits:

- Part of the larger Zoho ecosystem

- User-friendly interface

- Scalable for businesses of different sizes

- Project accounting for service-based businesses

- Integration with other Zoho apps

Pricing: Zoho Books provides several pricing tiers, starting at $9 per month and extending to $29 per month for more advanced features.

4.5. Wave <a name=”wave”></a>

Wave is a unique accounting software option as it’s entirely free, making it an attractive choice for freelancers, micro-businesses, and startups on a tight budget. Wave’s focus is on simplifying the accounting process with features for invoicing, expense tracking, and receipt scanning.

Key Features:

- Invoicing and payment processing

- Expense tracking

- Receipt scanning

- Financial reporting

- Payroll (available as an add-on)

Benefits:

- Completely free accounting software

- User-friendly interface

- Essential features for freelancers and startups

- Receipt scanning for expense management

- Payroll available as an affordable add-on

Pricing: Wave’s core accounting software is free, but they charge for add-on services like payroll and payment processing.

4.6. Sage Intacct <a name=”sage-intacct”></a>

Sage Intacct is a cloud-based accounting software designed for mid-sized and enterprise-level businesses. It offers advanced financial management and automation features to streamline complex accounting processes. Sage Intacct is known for its scalability and ability to handle multiple entities and currencies.

Key Features:

- General ledger

- Accounts payable and receivable

- Budgeting and forecasting

- Advanced reporting and analytics

- Multi-entity and multi-currency support

Benefits:

- Designed for mid-sized and enterprise-level businesses

- Robust financial management capabilities

- Advanced reporting and analytics

- Scalable for complex accounting needs

- Support for multiple entities and currencies

Pricing: Sage Intacct provides customized pricing based on the specific needs and size of your business.

4.7. NetSuite <a name=”netsuite”></a>

NetSuite, owned by Oracle, is an integrated cloud-based business software suite that includes accounting as one of its core components. It’s suitable for businesses of all sizes and offers features for financial management, order management, and e-commerce. NetSuite is known for its comprehensive and scalable solutions.

Key Features:

- Financial management

- Order management

- E-commerce

- Inventory management

- CRM and marketing automation

Benefits:

- Part of a comprehensive business software suite

- Scalable for businesses of all sizes

- Integration with e-commerce and CRM

- Advanced financial management

- Robust inventory management

Pricing: NetSuite provides customized pricing based on your specific business requirements.

4.8. Kashoo <a name=”kashoo”></a>

Kashoo is a simple and user-friendly accounting software designed for small businesses and freelancers. It focuses on essential accounting functions, such as invoicing, expense tracking, and financial reporting. Kashoo is an